Not known Details About Trading Indicator

Wiki Article

Unknown Facts About Trading Indicator

Table of ContentsTrading Indicator for Beginners7 Easy Facts About Trading Indicator ExplainedWhat Does Trading Indicator Do?All About Trading IndicatorFascination About Trading Indicator10 Simple Techniques For Trading Indicator

Indicators are stats made use of to gauge existing problems as well as to forecast monetary or economic fads. Common technical indications consist of moving averages, moving typical convergence aberration (MACD), loved one stamina index (RSI), as well as on-balance-volume (OBV).They include the Customer Rate Index (CPI), Gross Domestic Item (GDP), and also unemployment numbers. Indicators are stats utilized to measure existing conditions as well as to forecast financial or financial trends. Financial indications are analytical metrics used to gauge the growth or tightening of the economic climate as a whole or sectors within the economic situation.

The index is a carefully viewed measure of economic task. The U.S. Department of Business uses ISM information in its analysis of the economic situation. For a lot of the 21st century, housing as well as property have actually been leading economic signs (TRADING INDICATOR). There are a number of metrics utilized to gauge housing development consisting of the S&P/ Case-Shiller Index, which measures home list price, as well as the NAHB/Wells Fargo Real Estate Market Index, which is a study of home contractors that measures the marketplace appetite for brand-new residences.

The 5-Second Trick For Trading Indicator

:max_bytes(150000):strip_icc()/dotdash_Final_7_Technical_Indicators_to_Build_a_Trading_Toolkit_Oct_2020-01-c7ccbebd39954ae6897d51a60037b888.jpg)

Making use of devices like the MACD and the RSI, technical traders will evaluate properties' rate graphes looking for patterns that will certainly suggest when to acquire or offer the asset under consideration.

Examine This Report on Trading Indicator

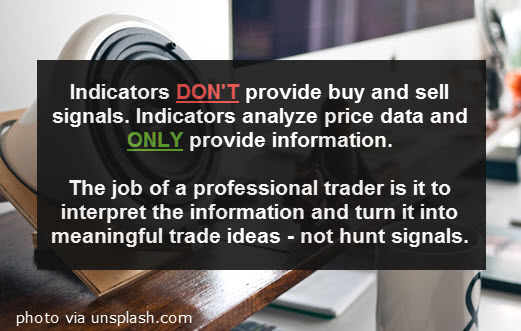

Indicator-based trading is used by new traders to identify fads in the market based on aesthetic signs. These are not as beneficial to investors that recognize just how to review rate graphes. Indicators can not anticipate specifically what will certainly take place. Usage signs with care, and experiment a trading simulator, especially if you are a new trader.Using signs is called "technical analysis," because it uses technological tools instead of fundamentals like balance sheet proportions. For instance, one preferred indication is the straightforward relocating average, which is used to show the instructions of a pattern and overlook the rate spikes that can occur in the short term.

The indication reveals a visual depiction of the mathematical formula and price inputs. To an unskilled chart reader or investor, Read Full Article a sign usually will not disclose more than what is noticeable just by evaluating the price graph (or volume) with no indications. Indicators provide you an aesthetic hint as to how rates are relocating.

The Best Guide To Trading Indicator

Many platforms enable you to choose the kind of chart you choose and use several indicators. The trading platform then automatically does the math to show whichever signs you have picked. In the chart below, you can see the long price decrease in Apple (AAPL) that started in very early April.An investor would certainly have discovered this sign a few weeks right into April and also would certainly have started investigating the circumstances bordering the decrease. Once they fit with the details wikipedia reference that supported the moving average, they would make trades based on whichever outlook they had for the supply. Trading, Sight There are several indications that traders can use.

Below are a few of the signs that traders use besides moving averages: Relocating typical convergence as well as divergence (MACD)Relative stamina sign (RSI)Bollinger bands, Price quantity pattern, Fibonacci retracement Indicator-based trading varies from pattern-based trading, where traders make actions based upon recognized graph patterns. There are hundreds of indicators, and brand-new ones are being created regularly.

Trading Indicator Can Be Fun For Anyone

A price or an indication can cross courses with another indicator. A different variation of the price-crossover strategy occurs when a shorter-term moving ordinary crosses a longer-term moving average. Crossovers happen in numerous signs.Signal signs are typically a relocating standard, but they are not made use of as an indicator in these techniques. Instead, they are used with various other indications to create trading signals. Other crossover signals include a loved one my company strength sign (RSI) relocating over 70 or 80 and after that back below, showing an overbought condition that might be drawing back.

Note that "much easier" in this instance does not mean more profitable. Indicators are outstanding tools for discovering just how to identify weak point or stamina in the price, such as when a trend is weakening. Brand-new traders might discover it testing to analyze a cost chart, however with the aid of some indicators, they are alerted of subtle changes they have not yet educated themselves to see on the price graph - TRADING INDICATOR.

The Best Guide To Trading Indicator

Indicators just show what costs have actually done, not what they are mosting likely to do. A relocating average could keep trending down, but that does not assure that it will certainly continue this way. An investor that comprehends how and what a candle holder or bar graph is informing them doesn't get anymore information from those graphes by adding signs - TRADING INDICATOR.

Each investor has to find indicators that benefit them and produce a revenue. Several approaches do not create an earnings, even though they are popular and well known. Indicators should be used with caution, as well as you must practice trading them by utilizing training software application prior to venturing right into the market as well as using your money.

Report this wiki page